EXECUTIVE SUMMARY

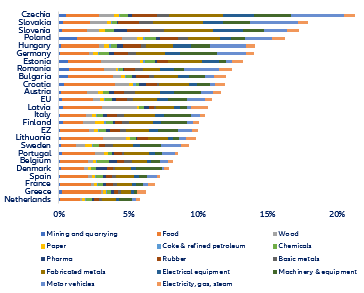

- The EU can easily manage an immediate embargo on crude oil imports from Russia. Within two months or so, OPEC members could step up crude oil production to the levels of H2 2018 (which implies +3.3 Mbb/d vs. Q1 2022) and Norway, the US and the UK could add another +0.5 Mbb/d to global output. This would more than compensate for Russia’s current crude oil exports of 3 Mbb/d. If the EU implemented the embargo today, we would expect to see two months of higher and volatile global oil prices, after which they should recede to current levels.

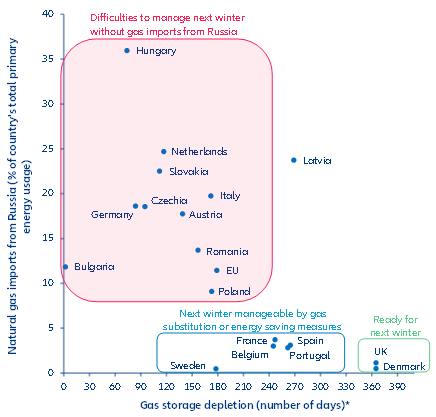

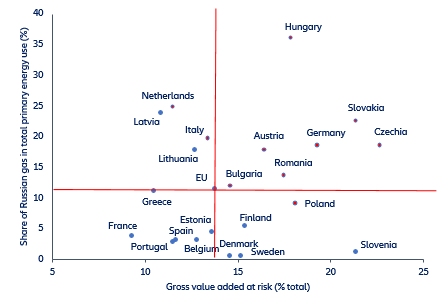

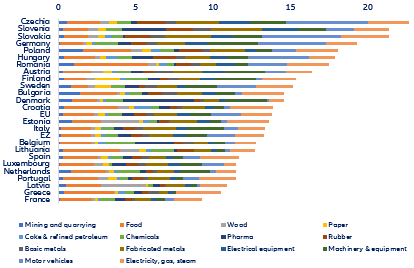

- In contrast, an immediate stop to natural gas imports from Russia would likely cause serious energy-supply disruptions for many EU member states. Should a “black-out” scenario – i.e. a full stop to all Russian energy exports – materialize by Q3 2022, countries that are heavily reliant on Russian gas, including Bulgaria, Hungary, Germany, Czechia, Slovakia, the Netherlands, Austria, Romania, Italy and Poland, would struggle the most next winter. Tapping new suppliers, substitution of gas by other energy sources and some self-rationing by the private sector in response to sky-high prices would not be enough to close the emerging gas supply gap.

- With the risk of a “black-out” scenario sizeable and the associated economic costs potentially significant, it is high time to prepare for all eventualities. Mitigating policy measures need to be taken now, including (i) preparing the public for the downside scenario; (ii) boosting gas buffers via gas-saving efforts; (iii) agreeing on an EU gas shortage mutualization scheme, as well as a joint purchase scheme for LNG to keep a lid on supply disruptions and in turn economic costs and (iv) deciding on a fair burden-sharing compromise across economic sectors at the national level to ring-fence the negative implications on industry and in turn employment.

The EU can easily manage an immediate embargo on crude oil imports from Russia.

Following several weeks of discussions, the EU Commission last week put forward a new package of sanctions against Russia, including a six-month phase-out of Russian crude imports and a phase-out of refined products by year-end. Hungary, Slovakia and Czechia would be exempted until 2024. These countries have been reluctant to sign up to sanctions involving energy, given their heavy dependence on Russian oil and on their neighbors for supplies as they are landlocked.

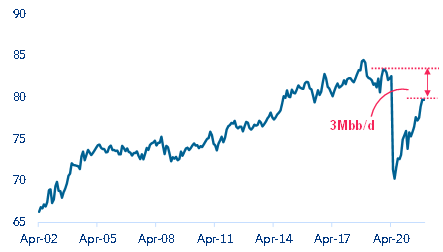

However, according to our calculations, Europe could implement a crude oil embargo immediately. Russia provides about 3mn barrels per day (Mbb/d) of crude oil to global markets. Although not all of that supply goes to Europe, the amount is a good benchmark for the volume of crude oil that would need to be substituted via other suppliers to balance supply and theoretically stabilize prices in the event of an embargo. In our view, OPEC alone could substitute for the 3 Mbb/d of crude if it increases its average production of 28.2 Mbb/d in Q1 2022 to the level of H2 2018. Back then, in the absence of any agreed oil-production cuts, OPEC provided an average 31.5 Mbb/d. If agreed on, going back to this level should not take longer than one or two months. Moreover, Western non-OPEC oil producers (Norway, US, UK) are estimated to be able to provide an additional 0.5 Mbb/d of crude to European markets in the near term. Looking at global crude production supports our view: Global output is currently about 3 Mbb/d below pre-Covid-19 levels (see Figure 1) while Russian output is the same as prior to the pandemic. As a result, non-Russian producers should be able to close this gap, albeit after one or two months.

Figure 1: Global crude oil production (Mbb/d)