EXECUTIVE SUMMARY

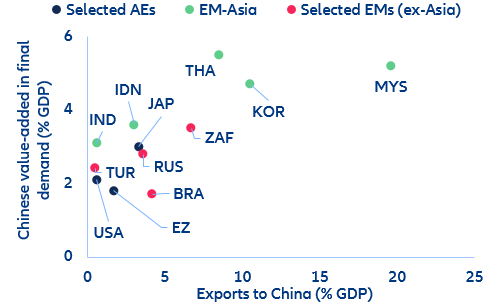

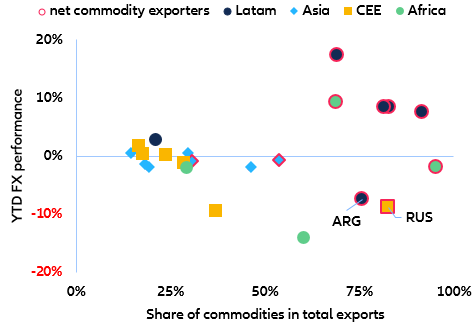

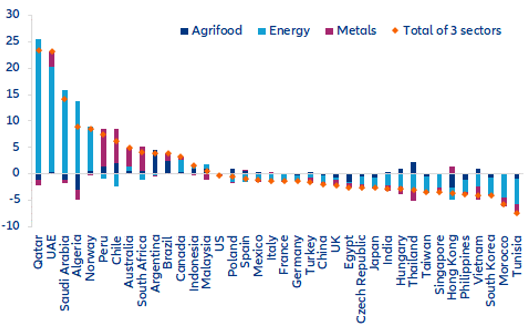

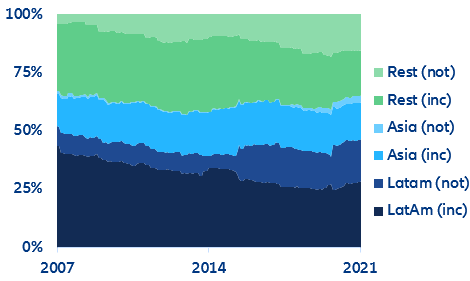

- Financial tightening in advanced economies and slowing trade growth have created less favorable conditions for emerging market sovereigns, which have been amplified by the effects of the war in Ukraine on commodity prices. While the capital accounts of emerging market sovereigns is often crucially influenced by the US monetary stance, their current accounts are very much dependent on demand from China due to their upstream integration in global supply chains.

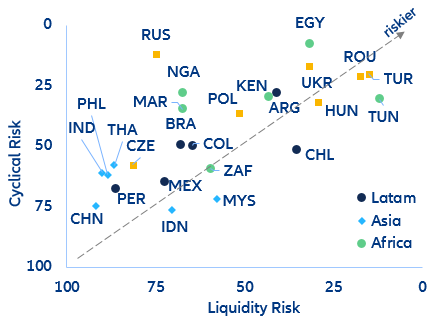

- A repeat of sovereign debt crises similar to the ones in the 1980s and 1990s appears unlikely. However, several (large) emerging market (EM) economies have become highly vulnerable to tighter financing conditions, including those in Emerging Europe (Hungary, Romania and Turkey) and Africa (Egypt, Kenya and Tunisia), as well as in Latin America (Argentina and Chile), albeit to a lesser extent.

- Under baseline conditions, we expect a broad-based but contained spread. In local currency terms, divergences between countries are as heterogeneous as inflationary pressures. Local currency yields will remain elevated in 2022, with a gradual reversal in 2023 as headwinds start to abate. Should our adverse scenario materialize, we expect the escalation of the war in Ukraine to cause a global recession with significantly higher inflation. Such a scenario would translate into a deterioration of EM fundamentals and generalized capital outflows, leading to a significant widening of hard currency spreads and a strong increase in local currency yields.

Even before the invasion of Ukraine disrupted capital markets, emerging markets and developing economies (EMDEs) were already facing a reversal of fortunes via both the capital and current account channels.

Capital Account Channel: Tightening US Monetary Policy

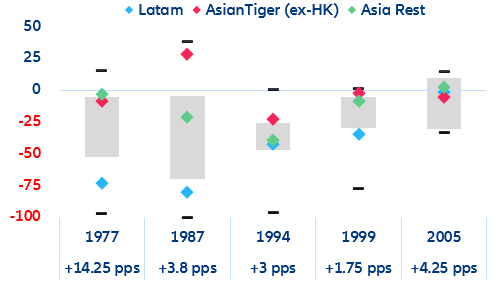

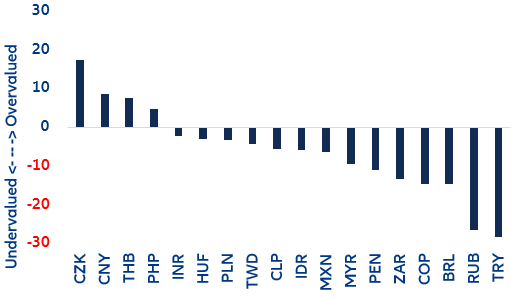

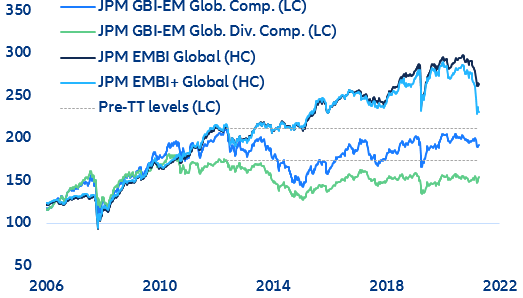

Financial conditions in advanced economies have significantly tightened since the beginning of the year; however, the US Federal Reserve’s shift to a hawkish monetary policy stance to combat surging inflation is also making investments in EMDEs less attractive in US dollar terms. As a result, countries will struggle to attract foreign capital as US real rates start rising, especially when their inflation is just as high (or even higher) than that of the US. Past evidence suggests that rising US rates tend to trigger significant FX pressures in EMDEs (Figure 1).

Figure 1: Impact of rising US interest rates on emerging market currencies (%)