EXECUTIVE SUMMARY

- The starting shot for Germany’s green transformation, the Easter package announced last month calls for a near tripling of electricity generation from renewables by 2030.

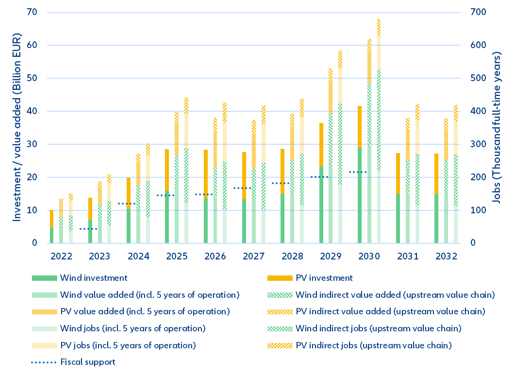

- But it is unfortunate timing for Germany’s green ambitions to shift into overdrive: The ambitious plans are likely to overwhelm German bureaucracy, and the prevailing context of heightened price pressures as well as input and labor shortages will mean Germany is likely to fall short of the near-term targets. Elevated costs and uncertainty call for additional sweeteners to ensure sufficient private sector financing to meet the investment needs up to 1% of GDP per annum.

- There is a big reward for getting it right: GermanyGermany’s green transformation comes with significant growth and employment benefits. We estimate the additional value added from implementing the Easter package at 1.4 times the investment needs or 2.7 times the fiscal support needs. Meanwhile, more than 400,000 jobs will be created until 2032.

The Easter package: The starting shot for Germany’s green transformation.

Five months after the formation of Germany’s traffic-light government, the Minister of Economics Robert Habeck presented his 600-page “Easter package”, the first comprehensive set of legislation to create the conditions for Germany’s shift away from fossil energy – at least as far as greening electricity generation is concerned. Going forward, only electricity from wind, sun and biomass is to flow through German grids instead of nuclear power, gas and coal. The five pieces of legislation are to be voted on by the German Bundestag in the next couple of weeks.

The package envisages green energy accounting for 80% of gross electricity consumption in Europe's biggest economy by 2030, up from 42% now and a previous target of 65%. Mean-while, domestic electricity generation is planned to be nearly greenhouse-gas-neutral by 2035, i.e., generated entirely from renewables. Germany is thus following the recommendation of the International Energy Agency (IEA) and drawing level with the ambitions of other OECD countries such as the US and UK, which are also aiming for a climate-neutral power supply by 2035.

But these are some ambitious targets. After all, assuming gross electricity consumption of 750 terawatt hours (TWh) in 2030, and to safely achieve the 80% expansion target, electricity generation from renewables will need to increase from just under 240 TWh at present to 600 TWh in 2030. At the same time, electricity demand is set to increase significantly due to the increasing electrification of industrial processes, heat and transport (sector coupling).

The Easter package also excludes heat and fuel, which together account for 80% of German energy consumption and continue to be produced predominantly from fossil fuels. As a result, it is only a first step, with further legislative proposals on energy efficiency in buildings and the reduction of greenhouse gas emissions in the transport sector to be expected later this year in the form of a “Summer package” and the “Masterplan Ladeinfrastruktur II” (masterplan charging infrastructure 2).

The invasion of Ukraine provides fresh urgency to greening plans.

In the context of the invasion of Ukraine, the pressure on Germany to reduce its reliance on Russian fossil fuels has clearly increased, adding additional urgency to its green ambitions. While the war in Ukraine has not led to an adoption of more ambitious long-term climate targets, the traffic-light government has responded with an acceleration of the short to medium-term investment targets in renewables. Furthermore the war in Ukraine should also help provide more support to the cause within the government coalition as well as among the German population. Moreover, the Easter package includes some elements that should allow for swifter implementation. Most importantly, going forward, investments in renewables will be categorized under “overriding public interest”, which should speed up planning and permit processes.

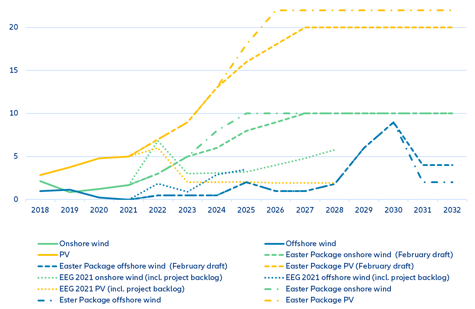

Figure 1 compares the renewable expansion plans of the previous German government (dotted line) with those of the current government before (dashed line) as well as after the invasion of Ukraine (dash-dot line). The reaction to the war (difference between the dashed and the dash-dot line) is planned to materialize primarily in additional onshore wind from 2024-2026 and additional photovoltaics from 2025 onwards. It should result in frontloading the full transition of the electricity sector from a climate-motivated 2045 to a Ukraine war-motivated 2035.

Figure 1: Comparison of pathways for renewable capacity addition