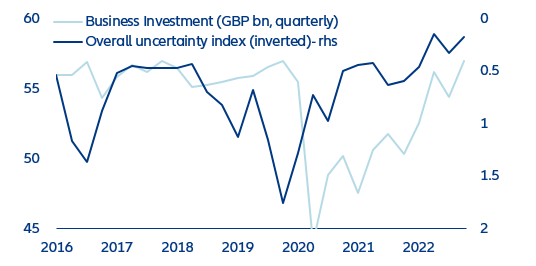

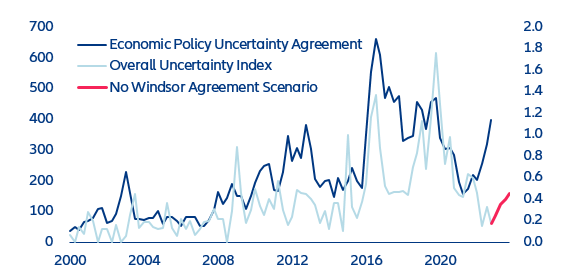

- Windsor Framework to the economic rescue – The lifted uncertainty could be sparing the UK economy 2.5% of business investment and a third of a GDP point in 2023-24.

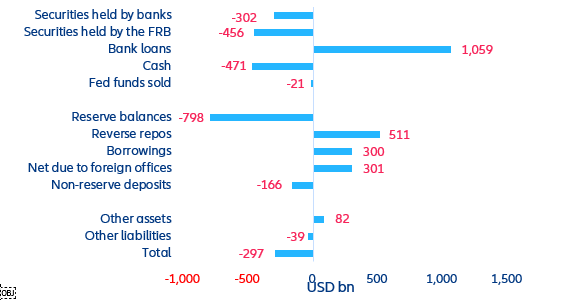

- US monetary aggregates – The Swan song? Since March 2022, US money supply has contracted; the last time this happened was during the Great Depression.

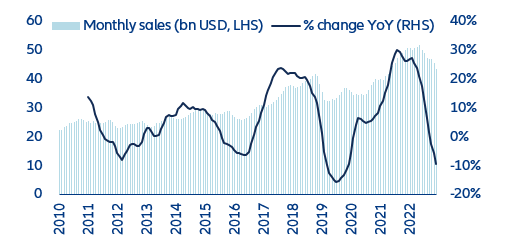

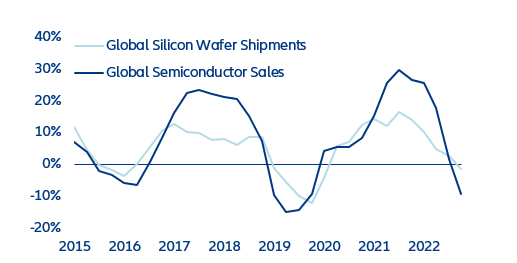

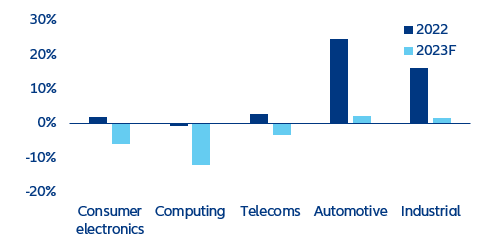

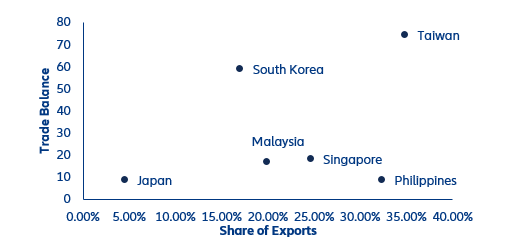

- Semiconductors – The end of the great chip shortage? The good and the bad of the 2023 semiconductor recession.

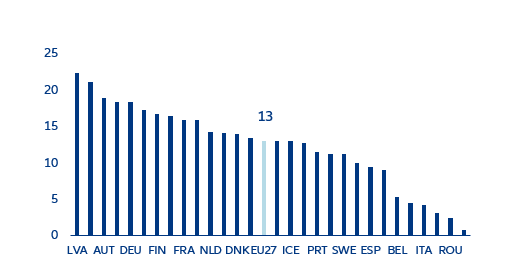

In focus – International Women's Day: Employ and pay them more!

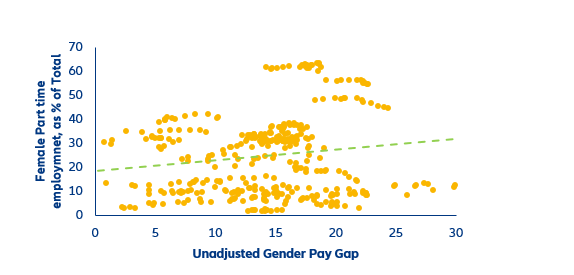

- In the EU, women get paid 13% less than men in terms of average gross hourly earnings. Although this is smaller than the global gender pay gap (20% according to the ILO), it does not necessarily reflect more gender equality; for some countries, it merely depicts lower participation rates in paid employment.

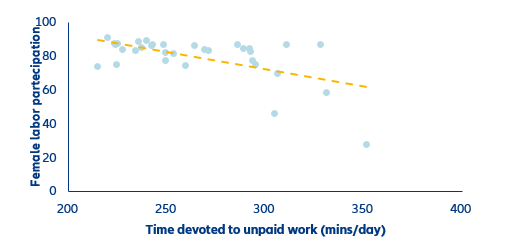

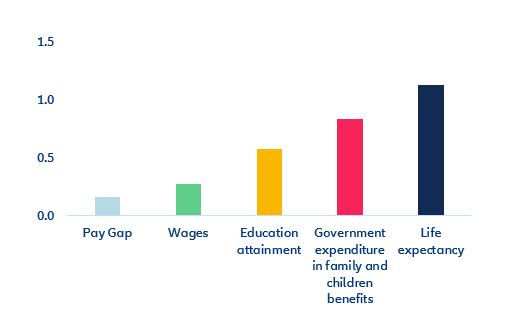

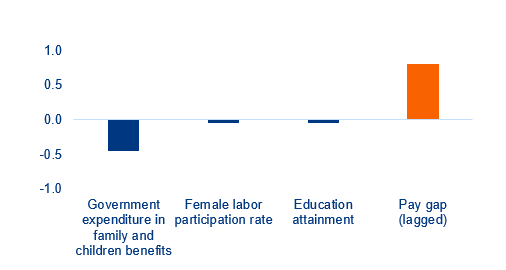

- Increasing female labor participation rates in developed economies makes economic sense. We estimate that life expectancy, tertiary education attainment and government expenditure in policies that support families and children have the strongest effect on female labor supply. However, the effects of labor costs (wages) and the unadjusted pay gap are more muted.

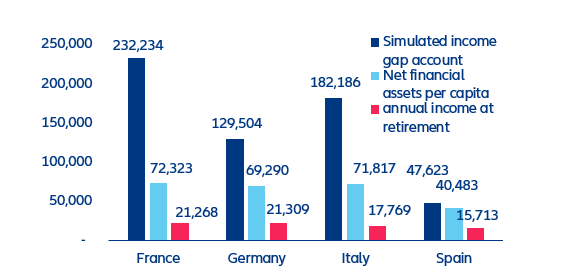

- According to our calculations, if invested, the income gap between men and women could represent almost 11 times the annual female retirement income in France, 10 times the annual retirement income for women in Italy, 6 times that of women in Germany, and 3 times the annual female retirement income in Spain.