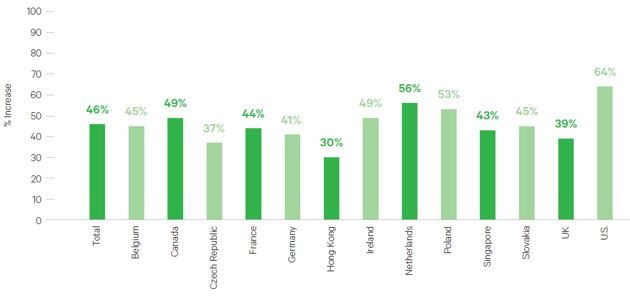

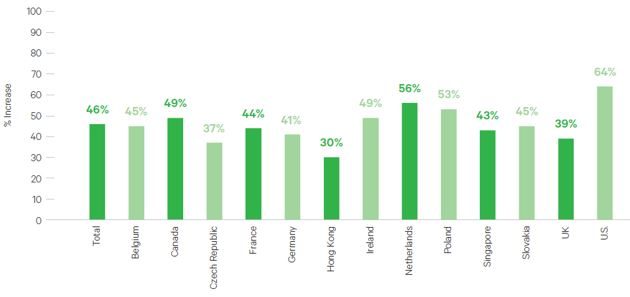

Less than half of SMEs expect a rise in sales in the next 12 months, according to the latest Global Business Monitor study from global SME partner, Bibby Financial Services and global leader in trade credit insurance Euler Hermes. The study surveyed more than 2,300 SMEs in 13 countries across Asia, Europe and North America. Discover the key findings below:

International Analysis

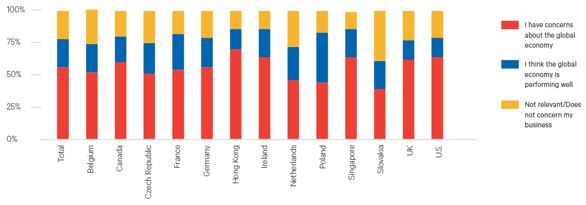

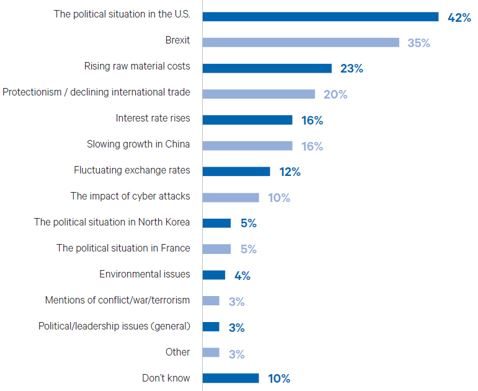

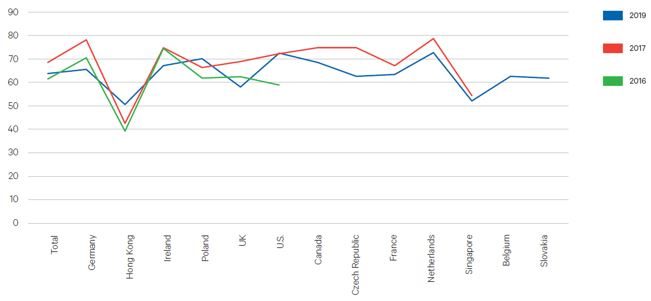

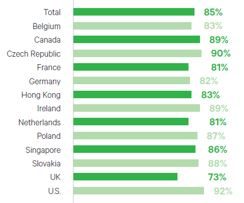

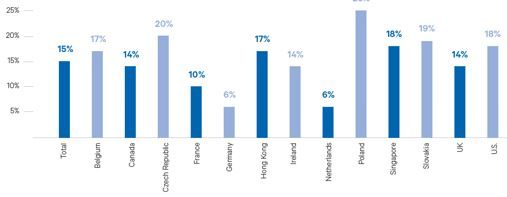

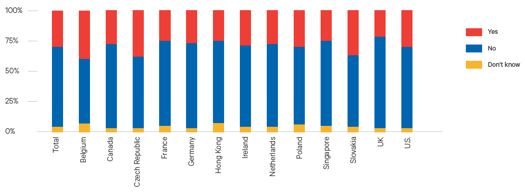

Overall, the proportion of SMEs voicing concern about the global economy has fallen to 56 per cent from 65 per cent in 2017. However only 20 per cent of SMEs think the global economy is performing well, down from 30 per cent in 2017. Views differ by region and are influenced by the degree of dependence on international rather than domestic trade. SMEs in Hong Kong are most concerned (70%) compared to 2017, when it was Singaporean SMEs that were most concerned (79%). The reasons for concerns vary from country to country, but common themes emerged around global politics, rising costs and the administrative burden resulting from local legislation and red tape. In 2017, at 41 per cent, Czech SMEs were most positive about the global economy, compared to 39 per cent of Polish SMEs that were most positive about the global economy in 2019.