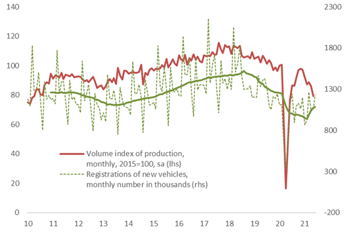

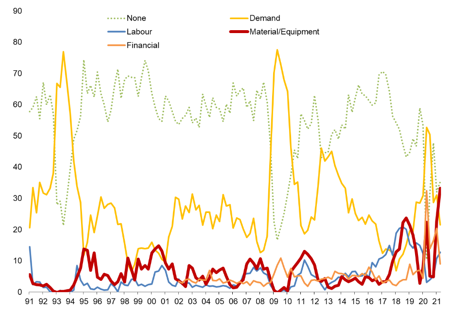

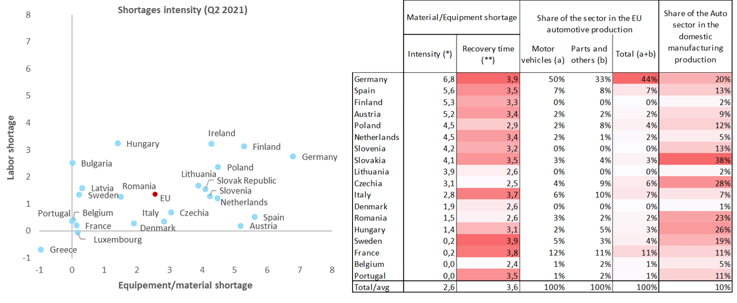

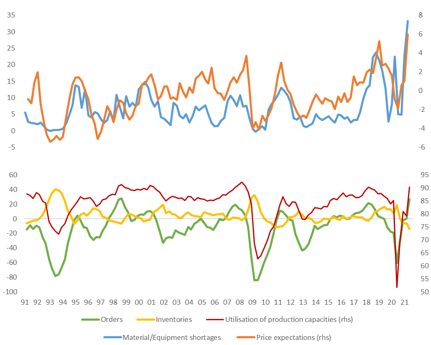

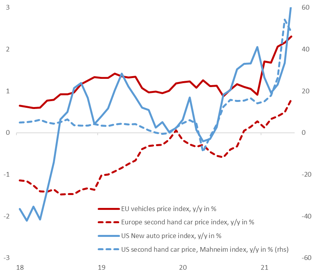

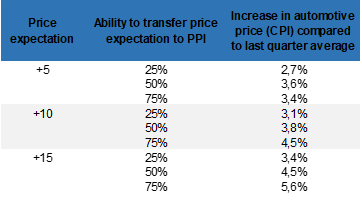

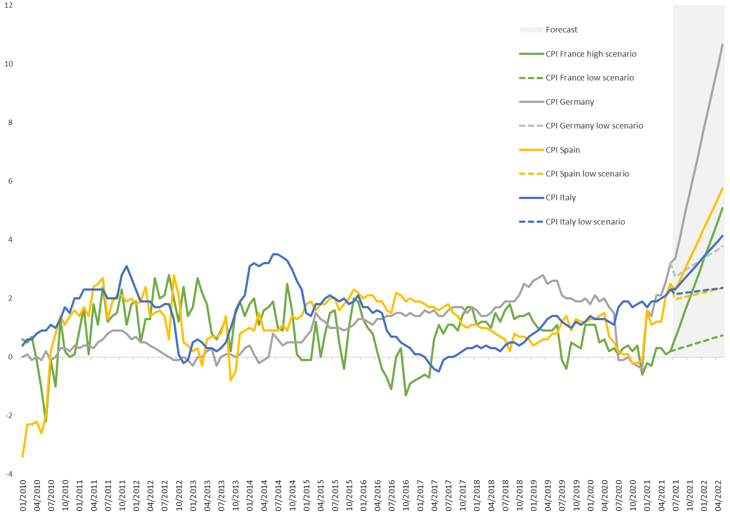

An unprecedented and intensifying shortage of materials, notably semiconductors, is creating a supply-demand mismatch in Europe's automotive sector that could last until H1 2022. This creates a unique window of opportunity for carmakers to raise prices by +3-6% after nearly 20 years of constraints. Over the first half of this year, demand for new vehicles in Europe benefited from the grand reopening: new car registrations grew by +25.2% to almost 5.4mn passenger cars (+1.354mn units) compared to the first half of 2020 (see Figure 1), with significant double-digit gains in most countries, notably the top four markets (+14.9% in Germany, +28.9% in France, +51.4% in Italy and +34.4% in Spain). This improvement is not yet sufficient to recover pre-crisis volumes since the first half of 2019 recorded 6.916mn passenger cars (i.e. +1.553mn units). Nevertheless, it has already and noticeably contributed to improving business sentiment in the sector, as evidenced by Eurostat business surveys on factors limiting production (see Figure 2). According to the latter, in Q2 2021, the factor “demand” posted a large drop from the high levels reached in Q2 and Q3 2020 to reach H1 2019 levels, i.e below the long-term average.

Figure 1 - Production and sales of new vehicles, EU-27

Figure 1 - Production and sales of new vehicles, EU-27