Source: Allianz Research

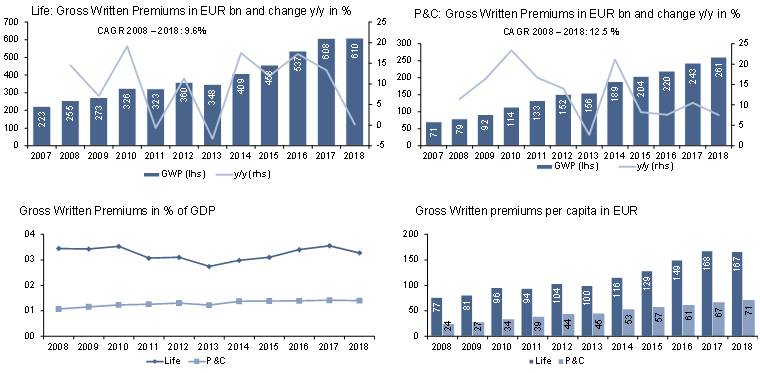

It is no surprise that the largest growth comes from the less developed nations where there is still room for improvement. Overall, the best performers in 2018 were Vietnam and Laos, which had y-o-y growth of +26.3% and +24.6%, respectively. The Philippines, Sri Lanka and India also clocked double-digit growth in 2018. At the other end of the spectrum sit the developed markets of the region like South Korea (-1.9%), Taiwan (+2.6%) and Singapore (+3.1%) – as well as China (+1.2%), for the above-mentioned reasons.

Digitalization and premium growth – no longer business as usual

New technologies are causing a seismic shift in the insurance industry as AI (artificial intelligence) and its related technologies are embedded into the business. The choice is now clear: the new normal of the industry is to innovate or perish.

Insurance revenue, in the scope of our study, is measured by the written premiums from life and p&c products. The effect of new technologies on these premiums is potentially huge. Machine-learning and AI-related technologies provide better analytics for pricing premiums. At the same time, these technologies – embedded, for example, in new devices like wearables – allow insurers and customers to start focusing on risk prevention rather than risk management. The consequence: Frequencies of claims should come down, though losses per event might go up. A case in point is the mobility revolution with its promise of less accidents by (semi-)autonomous driving but potentially huge losses in the case of a system-wide breakdown. But that’s not all: New technologies are being used to optimize costs along the entire value chain, not only for underwriting. Equally important are simplified distribution – say, one-click distribution platforms – and automated claims handling. Even investments are not spared: In the future, robo-advisers might steer the investment process. All these developments point to lower premiums.

On the other hand, new technologies are also creating new products, from cyber security to so-called UBI products (usage-based insurance), generating new demand for insurance. Cyber insurance, for example, offers huge opportunities, from insurance against cyberattacks to the protection of customer’s digital identities. And there is no denying that there will be a wider customer reach with digital platforms, both in the developed world and, in particular, in emerging markets. Given the still very low penetration in many emerging markets, the potential is also huge: A one percentage point higher penetration rate in emerging markets would have added EUR250bn in total premiums in 2018.

However, as the customer base increases, so does competition. New competitors will also come from outside the industry, from tech giants in China and the U.S. to insurtech-startups; incumbents will start looking for partnerships with these newcomers. Upon their establishment, they will provide insurance with customer experience at cheaper prices. Nonetheless, newcomers have yet to disrupt the market to a point where it makes traditional products obsolete. Currently, there is “only” an impressive disruption of the distribution process – not the business model itself - as most of the tech that is about to be deployed focuses on customer centricity. The golden rule is being quick and allowing easy transactions. As such, it is hardly innovative, but rather the new normal. In the future, the full process will be digital, from underwriting to claims management. The customer of the (near) future expects a single-click process with a personalized experience on a platform where you can not only buy insurance but also adjacent services.

The only certainty the insurance industry is facing is having its future reshaped. But the effect on premium growth is ambiguous: Lower frequencies of claims and declining operating and distribution costs suggest slower premium growth but the offsetting power of a wider customer reach and new products point into the opposite direction. It’s almost impossible to predict which power will have the upper hand.

Outlook for the coming decade

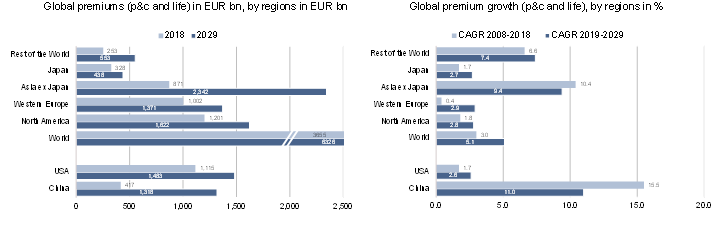

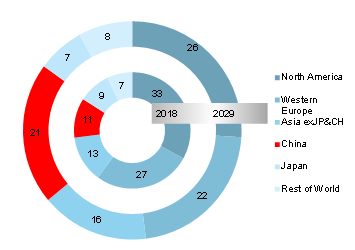

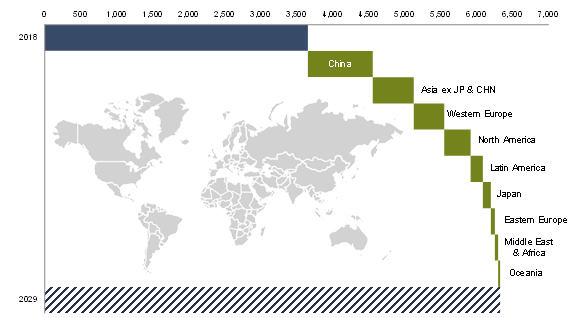

Long-term prospects look a little brighter than the current situation. Insurance markets should continue to recover over the long-run, with global premium growth to reach around +5% in the next decade. Over that period, however, global economic output is expected to grow by +5.6% (in nominal terms), so the penetration rate will not improve. The negative gap between premium and GDP growth is set to remain, albeit at a smaller scale. Given the accelerating demographic change, as well as underdeveloped social security systems in emerging markets, life insurance should again grow a tad faster than the p&c business (+5.5% vs. +4.4%), based on 2018 fixed exchange rates. (see Figure 7)

Our forecasts for total premium growth mask not only regional differences but also the large difference between advanced and emerging markets. Overall, we expect emerging markets to grow by +10.5% (life and p&c) and advanced markets by +3.2%. Besides different underlying growth dynamics, part of this difference is also explained by higher inflation and diverging paths of penetration: Whereas penetration is expected to rise in emerging markets (by around 0.8pp), it is set to decline further in advanced markets (by 0.4pp).

Figure 7: Outlook for global insurance markets