Executive summary

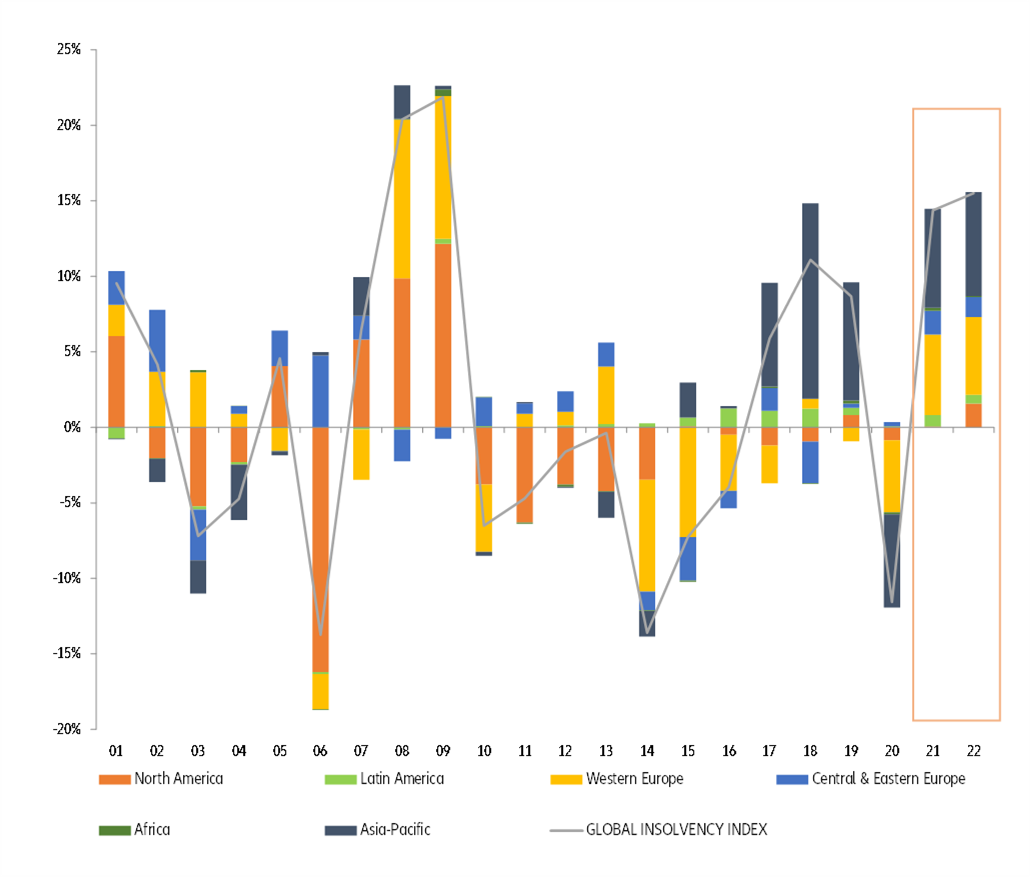

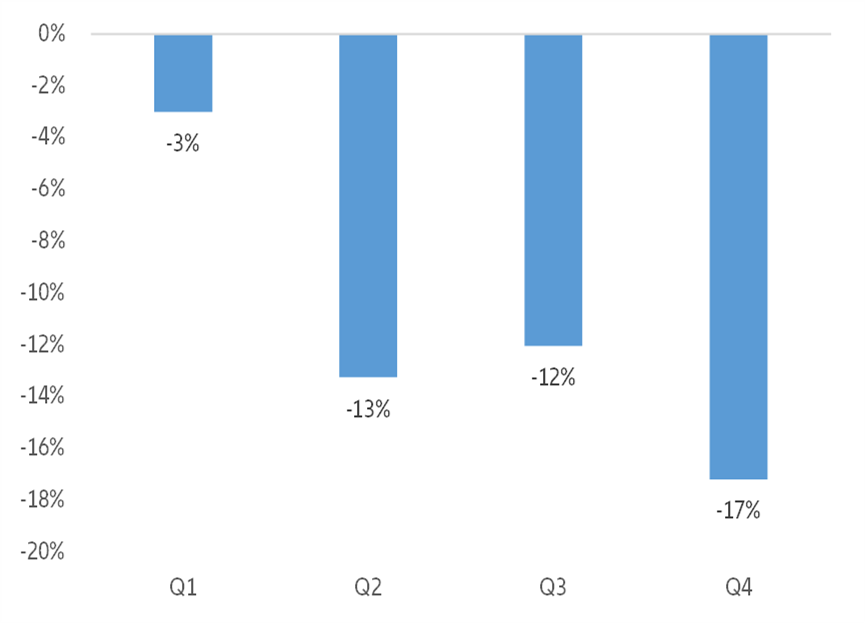

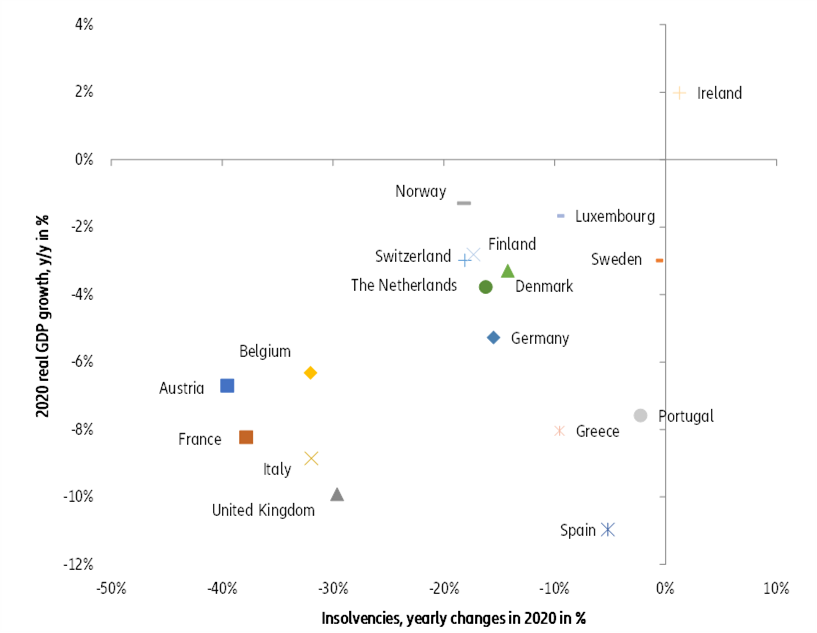

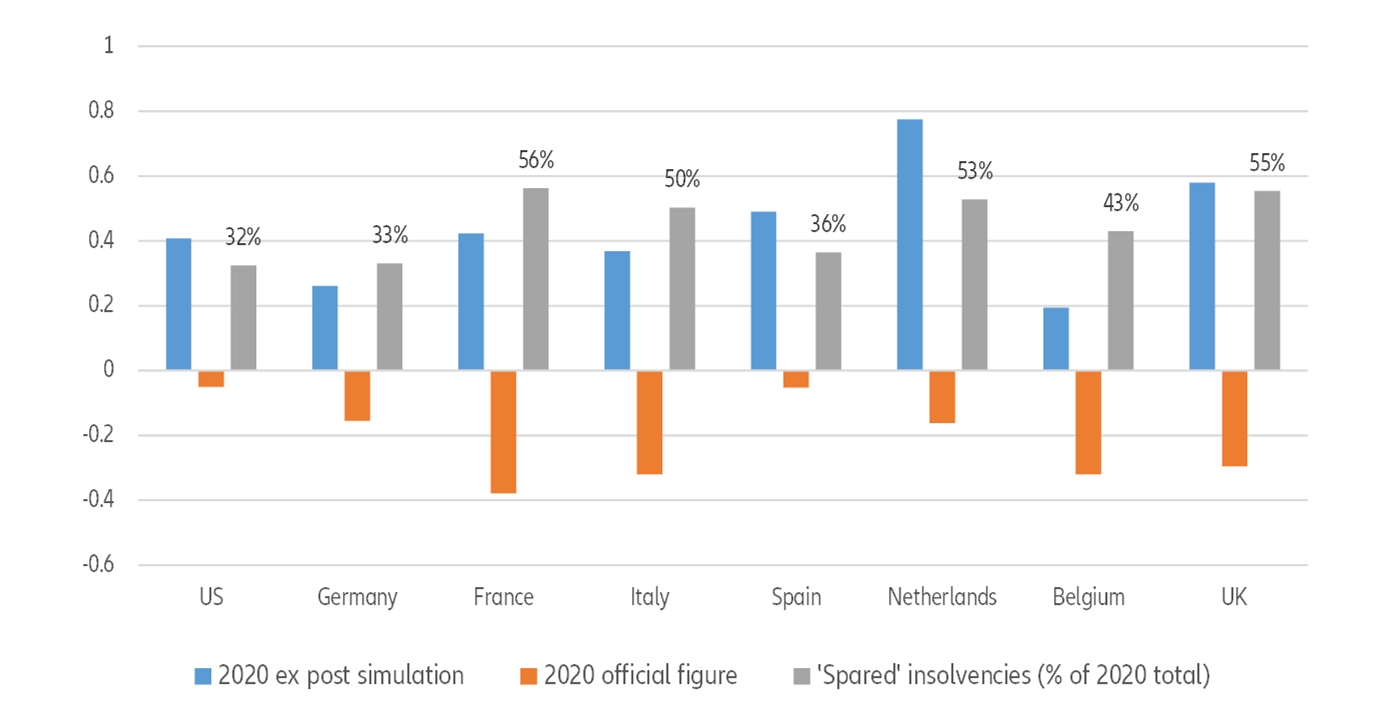

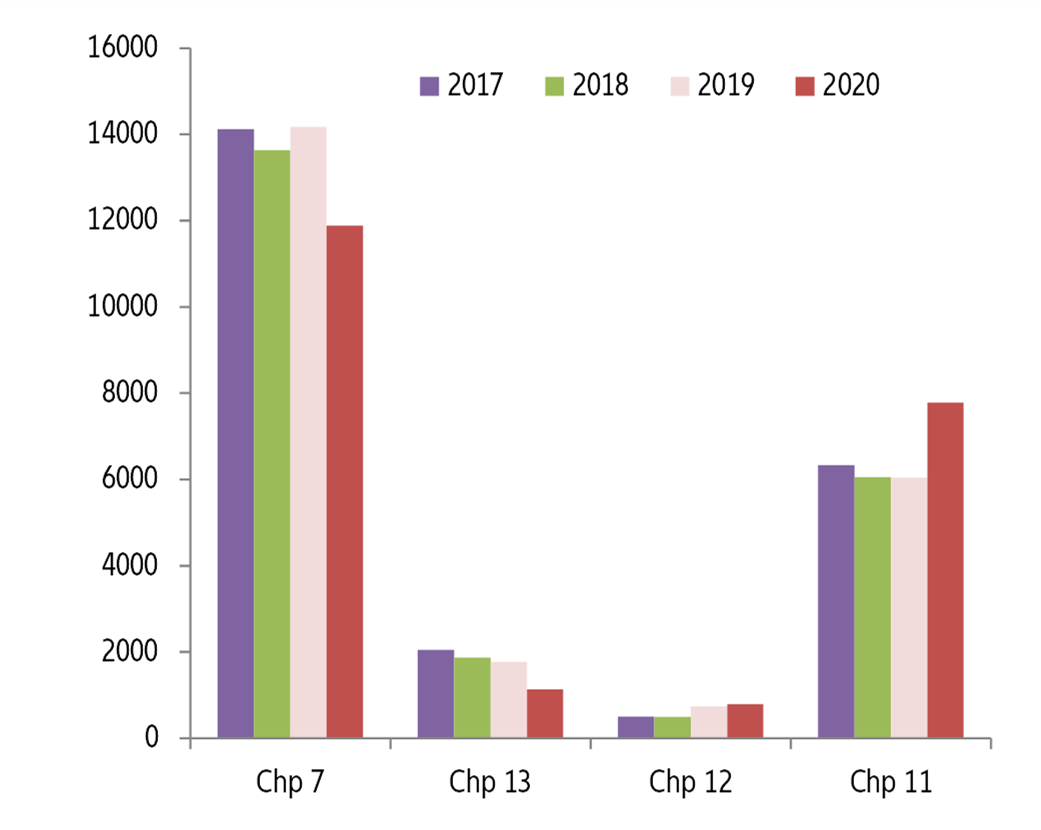

- Massive state interventions helped prevent one out of two insolvencies in Western Europe and one out of three in the US. Looking at the historical sensitivity of insolvencies to macroeconomic trends , we estimate ceteris paribus that the global economic shock could have resulted in a +40% surge in worldwide insolvencies in 2020. Instead, 2020 ended with a -12% decrease in insolvencies, meaning that the massive state support and further extensions of ‘whatever it takes policies’ prevented more than 35% of insolvencies globally, at least temporarily.

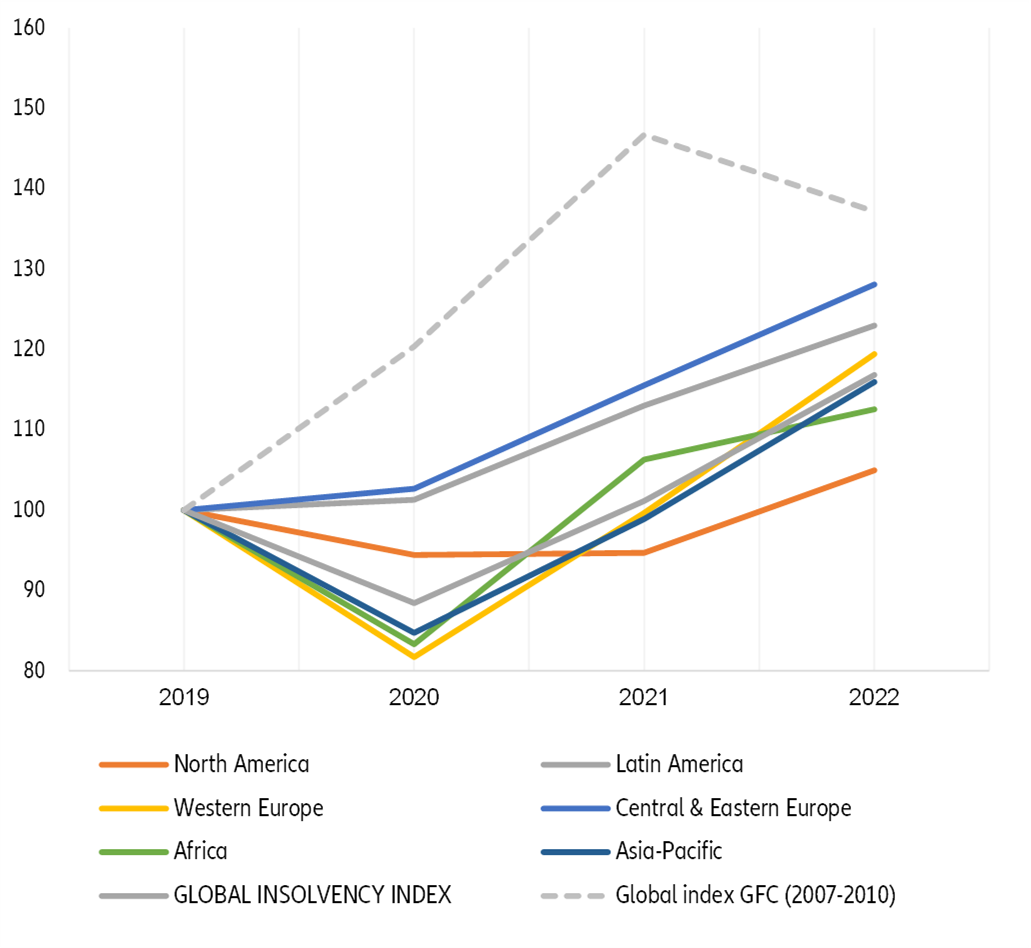

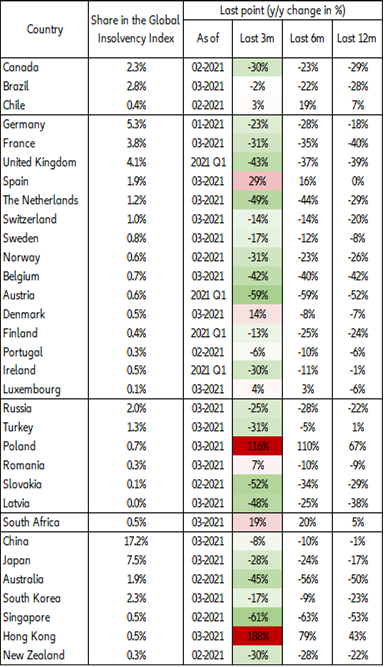

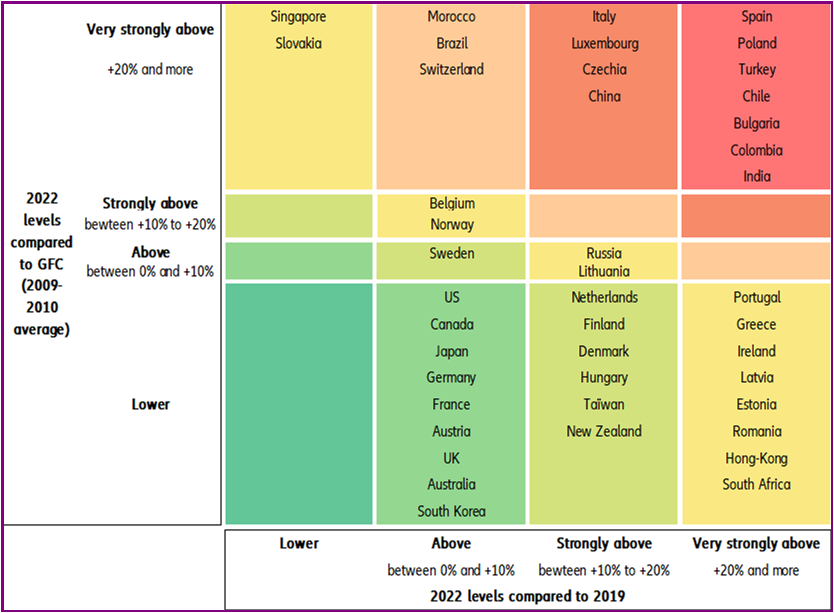

- Normalization from this paradoxical and artificial low has started and should gain traction later this year. Our Global Insolvency Index is forecast to rise by +14% y/y in 2021, and accelerate by +16% y/y in 2022. Significant increases due to base effects and inherent risks of reopening will lead to an increase in insolvencies starting in H2 2021. However, prolonging existing support measures could limit the number of insolvencies in the short term, raising the risk of more insolvencies in the medium and long term. The comeback of insolvencies will be both asymmetric, due to the multi-speed economic recovery, and gradual, due to a delicate but pragmatic phasing-out of support measures. We expect fine-tuned withdrawals to manage the pressure on companies’ liquidity and solvability. While business insolvencies are likely to exceed pre Covid-19 levels in (almost) all countries (by 17% on average), they will remain below levels seen after the 2008 Financial Crisis in advanced economies.

- The US will see low-for-longer insolvencies in both 2021 and 2022, with 21,600 and 23,860 cases, respectively, compared to 23,900 on average over the 2014-2019 period. This is due mainly to the combination of the Paycheck Protection Program (PPP) and the major boost expected from President Biden’s stimulus package.

- Europe: United in Insolvency Diversity. We have countries that will post the largest excess of insolvencies by 2022 compared to 2019, notably in Southern Europe due to a higher share of sectors sensitive to Covid-19 restrictions (5,750 insolvencies in Spain in 2022, compared to 4,162 in 2019; 13,000 insolvencies in Italy compared to 11,106 in 2019), and countries that will see the bulk of insolvencies materializing in 2022 and beyond due to the implementation and/or extension of the largest support packages (56,000 annual cases in France in 2022, 23,500 in the UK 23,500 and 19,600 in Germany).

Figure 1: Euler Hermes Global Insolvency Index and regional indices, yearly level, base 100 in 2019