Executive Summary

- The light and targeted lockdowns to fight the second wave of Covid-19 infections will constrain the pace of recovery. We expect global GDP to contract by -4.7% in 2020, followed by growth of +4.8% in 2021. Since April 2020, the global economy has been operating at 70%-80% capacity and we expect this situation to persist until Q4 2020, albeit to a lower extent, due to targeted lockdowns to combat new outbreaks and prolonged sanitary restrictions. A return to pre-crisis levels for the global economy is now expected only at the end of 2021. However, managing the risks of a second wave will be crucial in determining the size of the shock. Hot spots include Brazil, Mexico, the U.S, India, Indonesia,the UK and South Africa, countries that are particularly at risk of renewed outbreaks and false restarts.

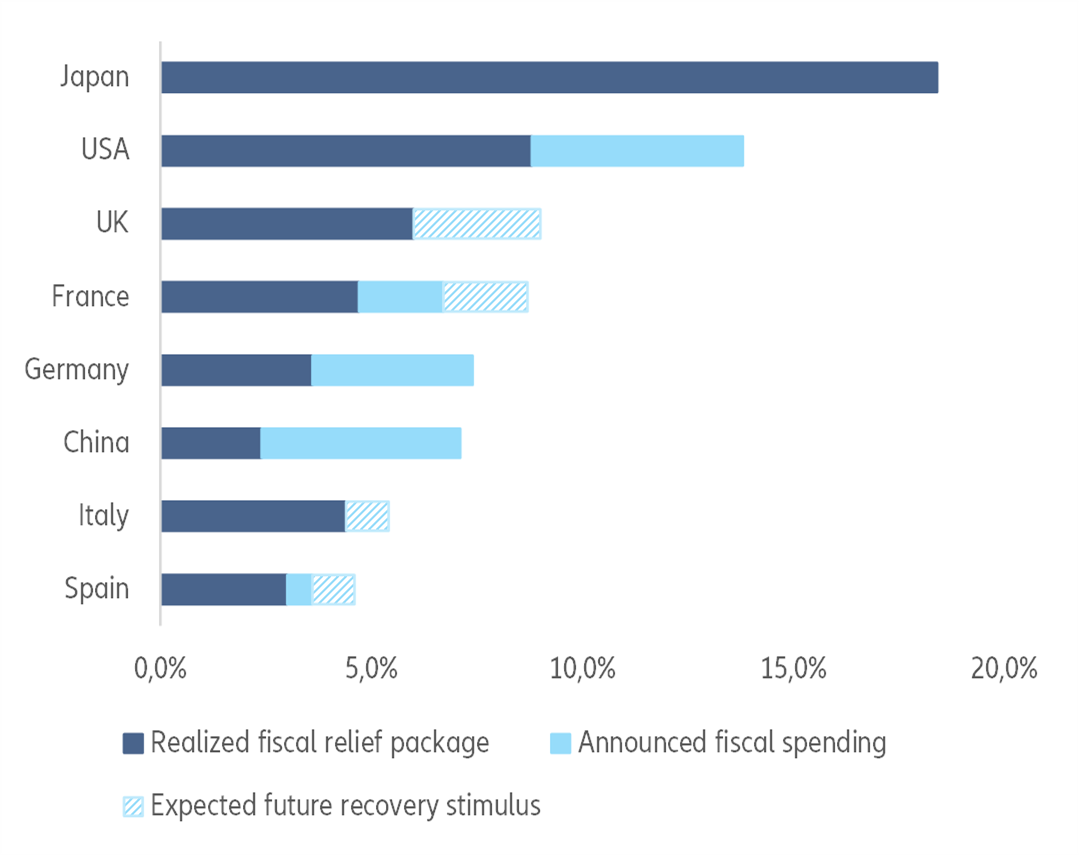

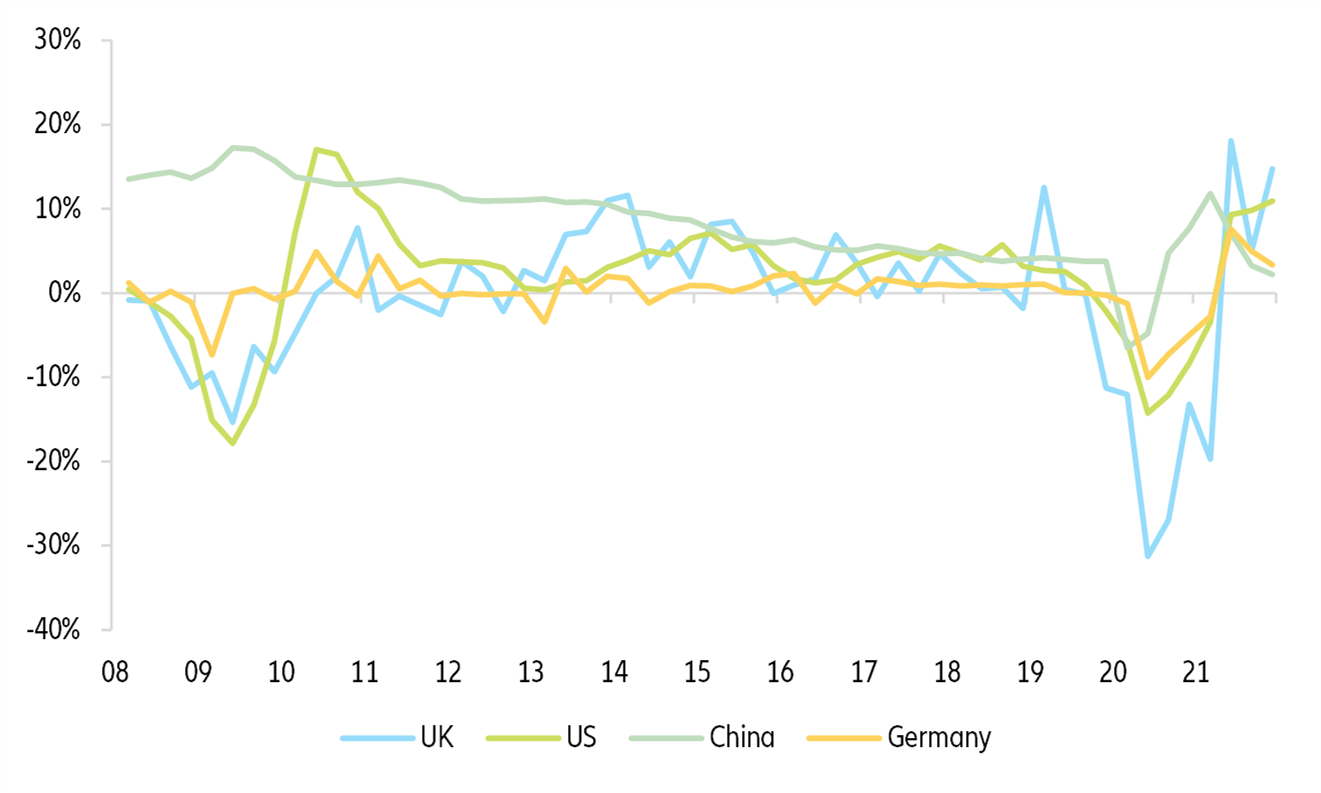

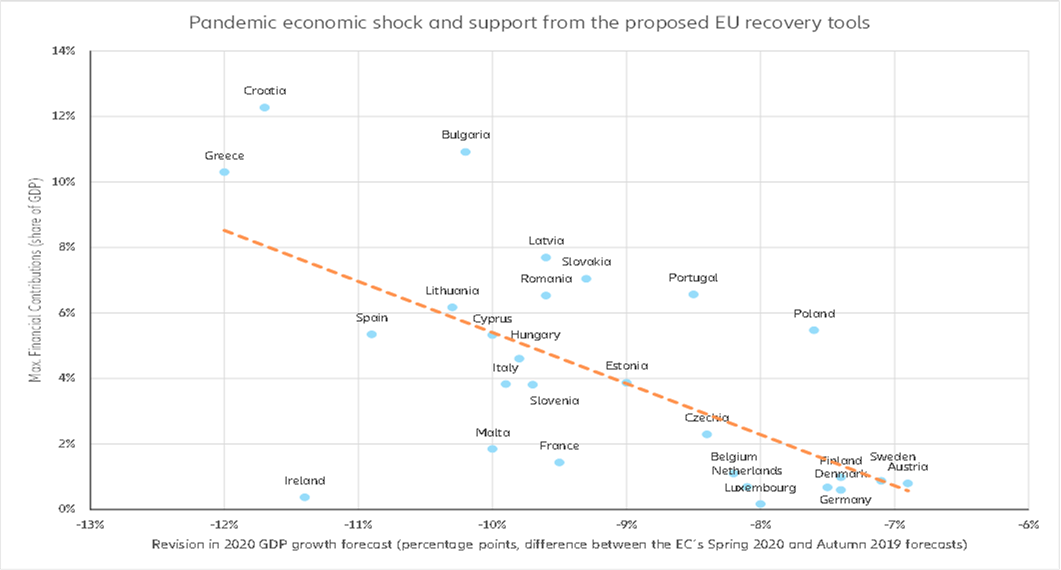

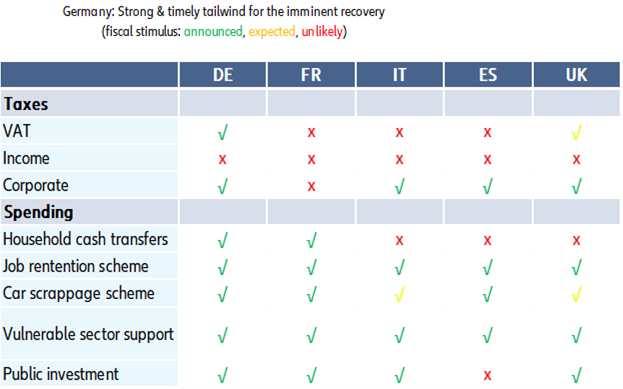

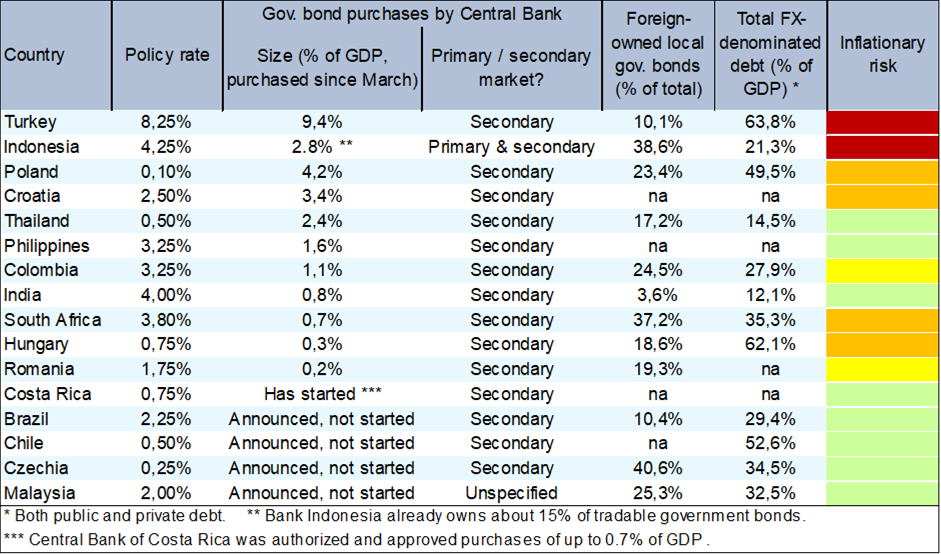

- Monetary and fiscal stimulus in response to the Covid-19 crisis has amounted to more than USD18tn in 2020, 1.3 times the Chinese GDP. But differentiated returns will create divergent recoveries. Our proprietary monetary impulse indices show the record high levels in the U.S., the Eurozone andthe UK. However, China’s is still a far cry from the peaks reached after the 2009 financial crisis. Meanwhile, global fiscal support has amounted to USD10.4tn since March 2020 (12% of global GDP), ranging from 3%-18% of countries’ GDP. This along with the size of automatic stabilizers will shape the future recovery trajectories by country. Germany, the Netherlands, Switzerland and Austria are expected to recover faster, while Japan, the U.S., Spain, the UK and Italy are likely to need even more fiscal stimulus to compensate for the weakness of automatic stabilizers. We expect Europe to reach its pre-crisis GDP level only in late 2022-2023 while China and the U.S. would reach theirs one year earlier, depending on the management of the second wave. The key question remains the recovery support to come, along with the targeted relief support for the hardest hit sectors until the end of the year. With higher solvency risks in H2 2020 and 2021, we expect global insolvencies to increase by +35% in 2020-21.

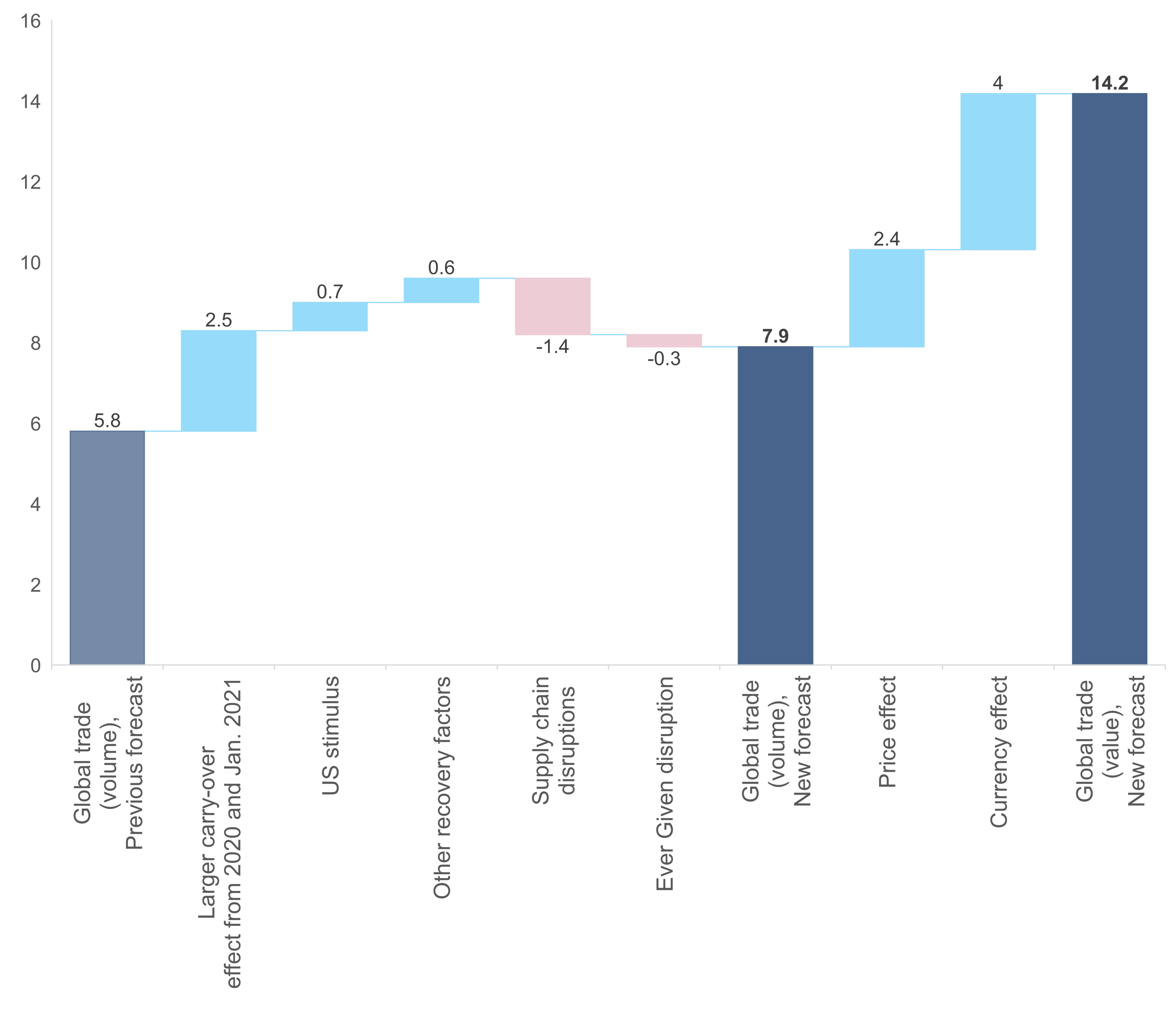

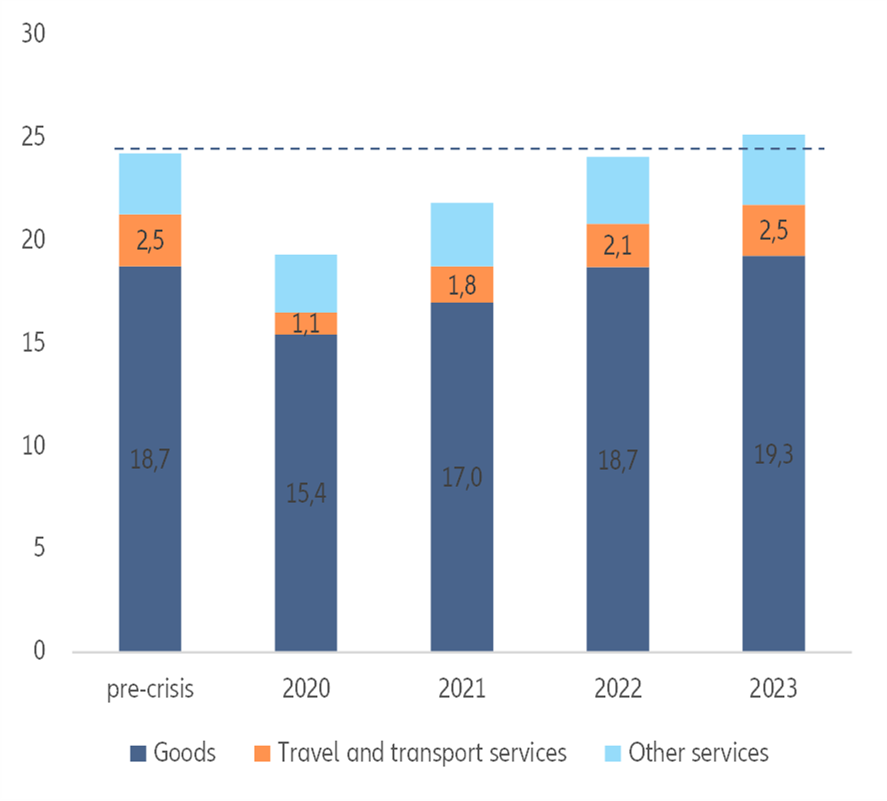

- Global trade is not expected to return to pre-crisis levels before 2023 as international flows in the services sector will remain impaired for longer. We expect a global contraction of trade by -15% in volume in 2020, with a recovery of +8% in 2021 and +4.1% in 2022. Export losses (USD4.5 trillion in 2020) will also reveal large asymmetries between countries and sectors. Service activities will take a much longer time to recover (2023 for travel and transportation services) compared with trade in goods, which is expected to return to its pre-crisis level by the end of 2022. We expect the energy sector to be hit the hardest (-USD733bn of export losses), followed by metals (-USD420bn) and transport services tied with automotive manufacturers (-USD270bn).

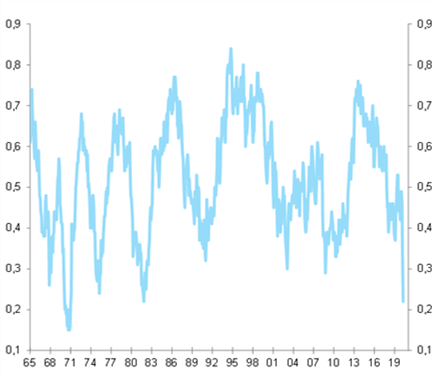

- “Pavlovian markets” will generate a regime of high volatility. Reacting to announcements of expansionary monetary and/or fiscal policy, markets tend to be overly reliant on the effectiveness of policy measures. We continue to believe global equity is over-valued. For 2020, we expect 10y Bunds to finish the year at -0.5% and 10y USTs at 1.0%, slightly above current levels.

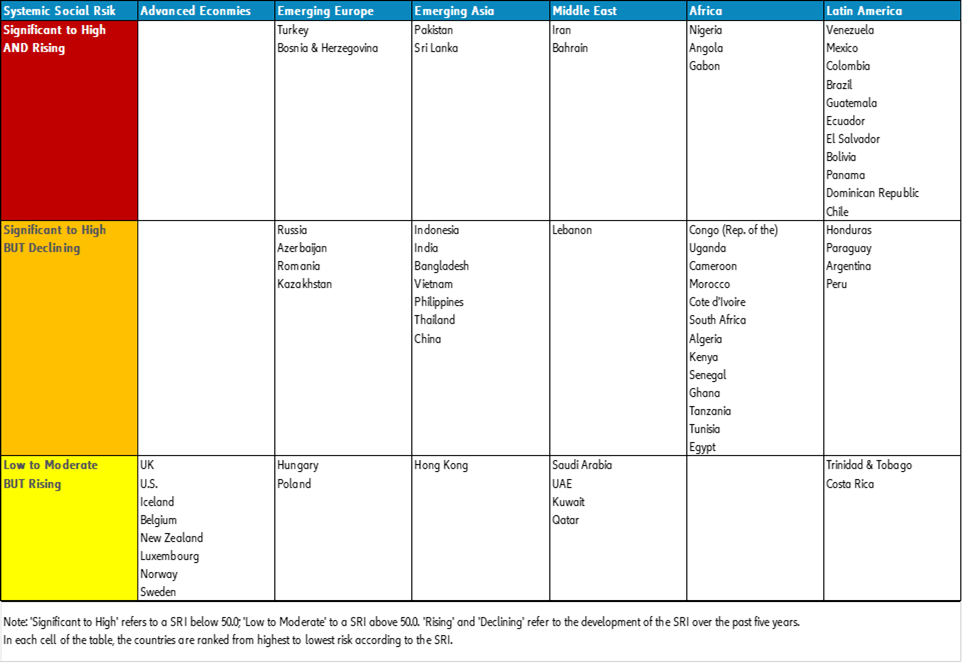

- In the medium term, we expect GDP growth to be impaired by the legacies of the crisis. We see an accelerating zombification of companies, banks and labor markets, a deterioration of social and political risk and definitive losses in terms of capacities of production. Compared to other developed economies, the U.S. is likely to lose -1pp over ten years mainly due to a large accumulation of public debt. While we don’t expect a trade regime shift (relocation/reshoring) in the short term, pre-Trump tariff levels are unlikely to return despite reduced U.S.-China trade uncertainty after the U.S. elections.

Light and targeted lockdowns to fight the second wave of Covid-19 infections will constrain the pace of recovery.

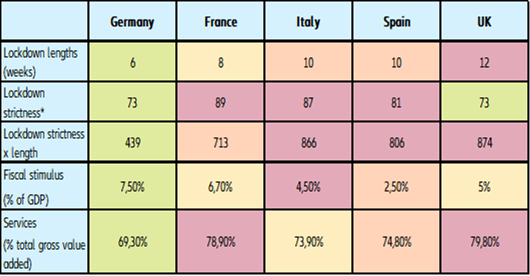

Back in April, we pointed out the gradual opening of national economies post lockdowns, which will prove long and cautious. Light and localized lockdowns are still likely, including border restrictions and event bans. Policy measures will be balanced between targeted relief measures for the hardest-hit sectors (hotels and restaurants, food and accommodation, transportation, leisure) and stimulus measures (VAT rate cuts, car scrappage schemes, green stimulus, public investment measures, company investment fiscal incentives…). Overall, the global economy is operating at 70%-80% capacity and we expect this to continue until Q4 2020 as countries could be forced to impose targeted lockdowns to combat new outbreaks of Covid-19 and to prolong sanitary restrictions until a vaccine is developed. Our analysis suggests that many countries still battle a too high effective reproduction rate (R0). Hot spots include Brazil, Mexico, the U.S, India, Indonesia, the UK and South Africa: these countries are particularly at risk of renewed outbreaks and false restarts as they do not yet have the pandemic under control. In the U.S. we expect the recession to be -2pp stronger (from the current -5.3%) should the lockdowns fighting the second wave be more generalized.

Currently high frequency indicators indicate a slow recovery in countries where initial conditions were weak and lockdown stringency the highest. The stringency index in China increased in June compared to May (one of only two of the main economies in this situation), reaching 79 vs. a global average of 66. Between the risk of renewed outbreaks and the extremely prudent de-confinement approaches, it is likely to be a long time before all containment measures are removed around the world. Stringency indices have been faster to rise than decline, particularly for international travel. Even in areas where lockdowns were not put in place, the stringency index still stood at an average of 30-40 in Q2 (e.g. Iceland, Sweden, Japan). This shows it will take time before we can witness a return to business as usual. We expect global GDP to fall by -4.7% in 2020, more than three times more than in 2009, and to grow by +4.8% in 2021. The return to pre-crisis levels is expected at the end of 2021 as the earliest, mainly driven by China and the U.S. Europe will need more time to reach pre-crisis levels, given the size of the shock — twice as high as in the U.S. — and the more limited stimulus response. We expect a return to pre-crisis levels only in late 2022-2023, with France, Italy, Spain and the UK being the laggards and Germany, the Netherlands and Sweden the fastest-growing economies.

Figure 1 - Deconfining: managing the effective reproduction rate (bubble size is stringency index as of end June)