Executive Summary

- As central banks around the world tighten monetary policy to cope with surging inflation, financing costs are set to rise for companies, contributing to the return of business insolvencies. In this context, recovering debt could become even more of a challenge. In the third edition of the Allianz Trade Collection Complexity Score and Rating, we analyze local payment practices, court proceedings and insolvency frameworks to identify the countries where it is most difficult to collect debt. This year, our ranking covers 49 countries that represent nearly 90% of global GDP and 85% of global trade.

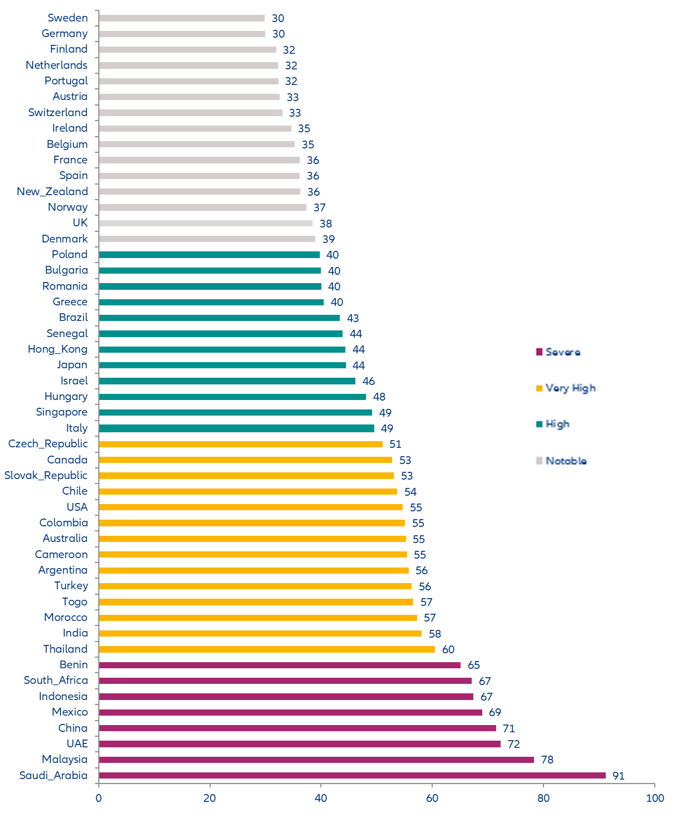

- Sweden, Germany and Finland are the three best countries to recover international debt in the world, while Saudi Arabia, Malaysia and the United Arab Emirates are still lagging behind when it comes to making it easier for (foreign) companies to recover their dues. International debt collection is almost three times more complex in Saudi Arabia than in Sweden, but the latter is not without complexities in terms of international collection. Globally, collection complexity stands at 49 on our 0-100 scale, which corresponds to a ‘high’ level of complexity out of a four-notch scale: ‘notable’, ‘high’, ‘very high’ and ‘severe’.

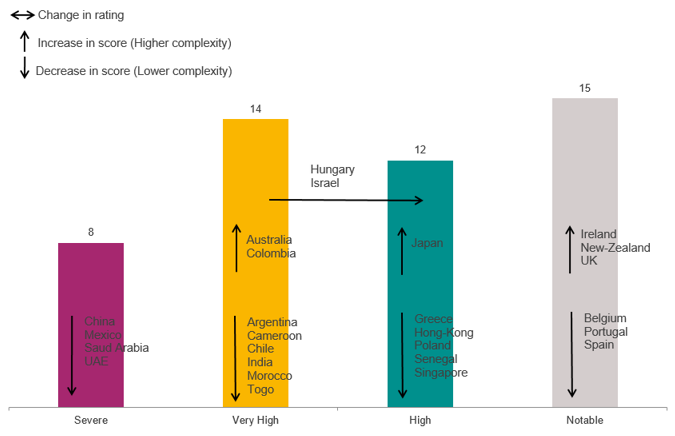

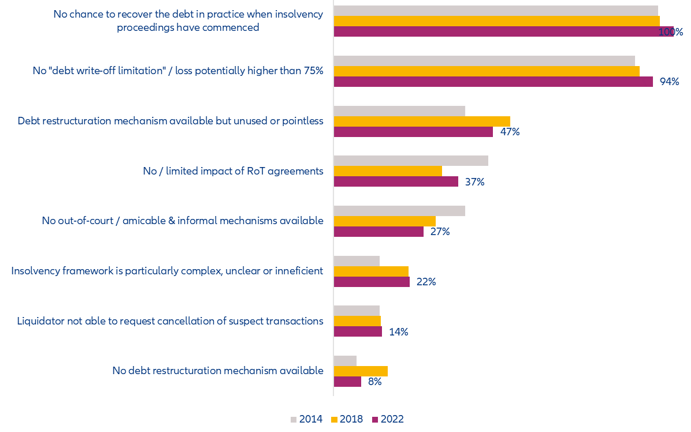

- In the past four years, 20 out of the 49 countries in our sample have seen their collection complexity score improving, including the most complex countries such as Saudi Arabia and China, in part because the Covid-19 crisis led many to accelerate reforms of insolvency frameworks. However, the changes were large enough to lead an improved rating for only two countries (Hungary and Israel).At the same time, while we also noticed some improvements in terms of preventive restructuring frameworks in the UK (with the new procedure moratorium), Australia and the EU (Directive 2019/1023), these have not yet reduced collection complexity. Six countries have seen their scores slightly deteriorate (Australia, Colombia, Japan, Ireland, New Zealand, UK).

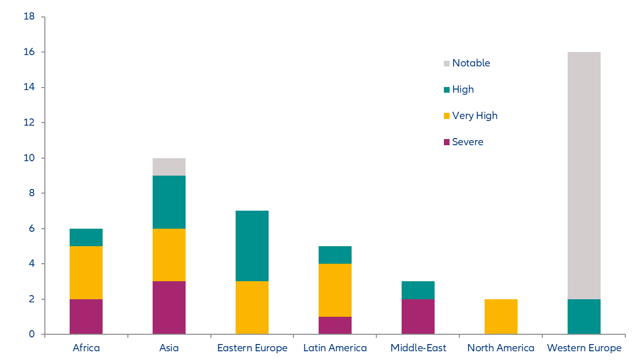

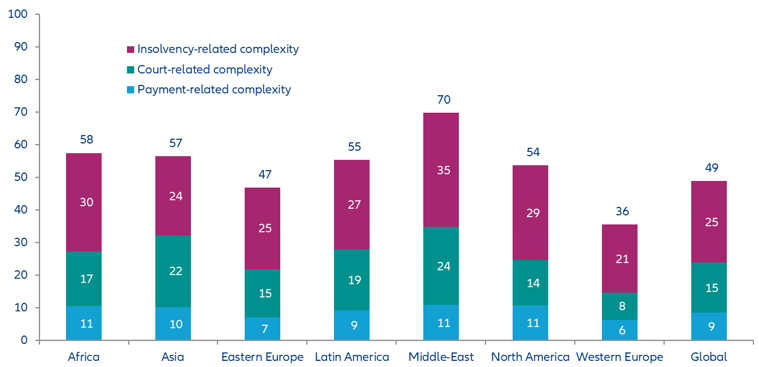

- Collection complexity has been reducing in emerging markets over time, gradually closing the gap with advanced economies. However, while most advanced economies have a ‘notable’ level of collection complexity, the US and Canada both post a ‘very high’ rating. On average, the Middle East, Asia and Africa are the top three most complex regions.

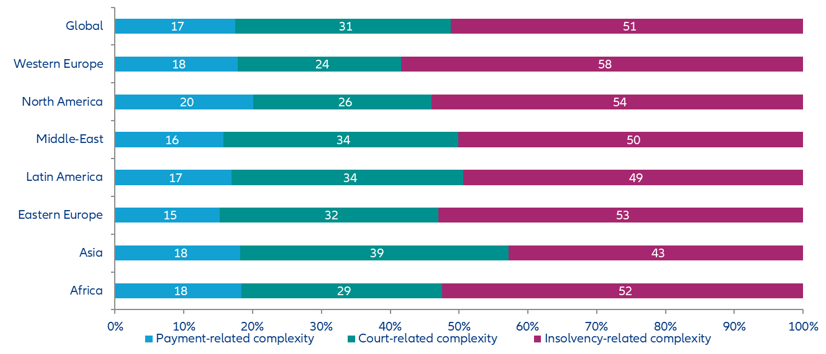

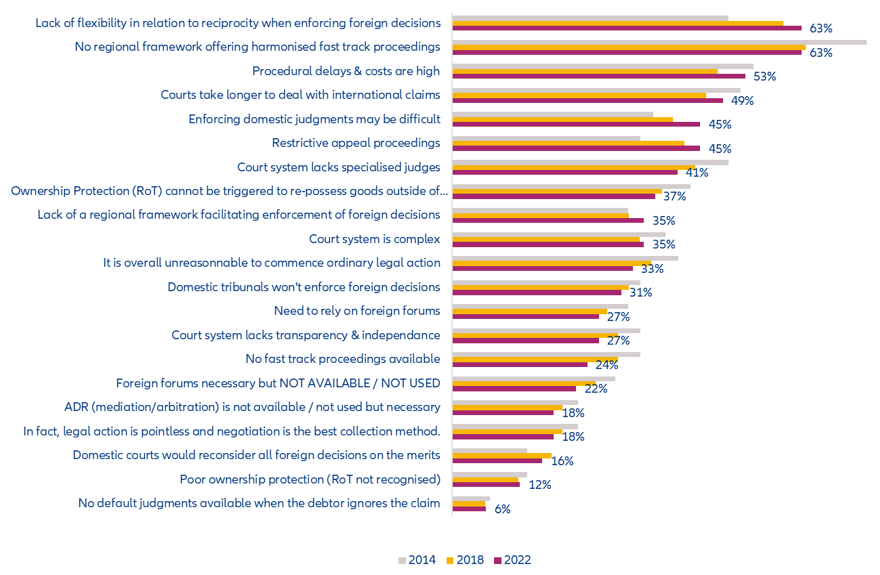

- The largest economies, most dynamic markets or less vulnerable countries (in terms of country risk) do not necessarily offer a more conducive business environment: Pockets of collection complexity exist in all countries in three key areas: local payment practices (17% of the collection complexity), local court proceedings (31%) and local insolvency proceedings (51%). Local payment practices, in particular, stand out in the Middle East but they are a source of complexity in most countries. Court-related complexities are slightly less frequent, notably within Western Europe and North America, but each occurrence is definitely more challenging. However, insolvency-related complexities are the by far the most predominant, contributing from 43% (Asia) to 58% (Western Europe) to global collection complexity.

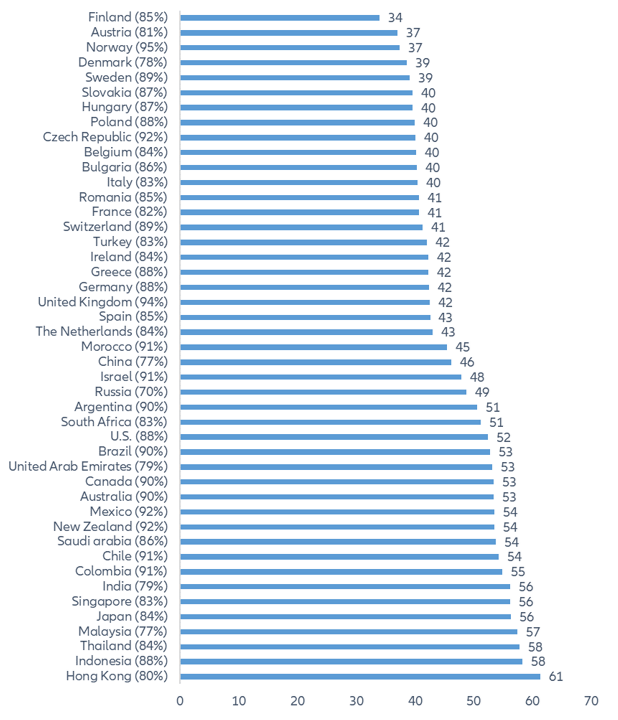

- Combining countries’ collection complexity scores with their share of trading partners , we can also calculate exporters’ exposure to international debt-collection complexity. Finland, Austria and Norway are leading the list of countries that are least exposed. On the other hand, Asia stands out with seven of the most exposed countries due to their higher share of international trade with countries where debt collection is more complex: Hong Kong, Indonesia, Thailand, Malaysia, Japan, Singapore and India.

- Overall, we estimate that trade receivables in the countries with a ‘severe’ level of collection complexity exceeds USD4.2trn, compared to USD3.5trn for countries with a ‘very high’ level of collection complexity and USD1.9trn and USD2.4trn for countries with ‘high’ and ‘notable’ collection complexity, respectively.

Figure 1: Collection Complexity score and ratings